Speculation Vs Hedging | Know the difference between arbitrage and speculation by angel broking experts. In computer architecture, what is difference between (branch) prediction and speculation?? This week, 17 senators wrote to the cftc calling for a plan to impose position limits in all energy futures markets. Now let us understand the difference. A question that comes up from time to time is the difference between hedging and speculating, and where to draw a line between the two.

Arbitrage and speculation are two distinct financial techniques. However, these two terms are very different from each other. Diversification is a portfolio management strategy that investors use to smooth out. While investing and speculating are not mutually exclusive, there are some key differences. In computer architecture, what is difference between (branch) prediction and speculation??

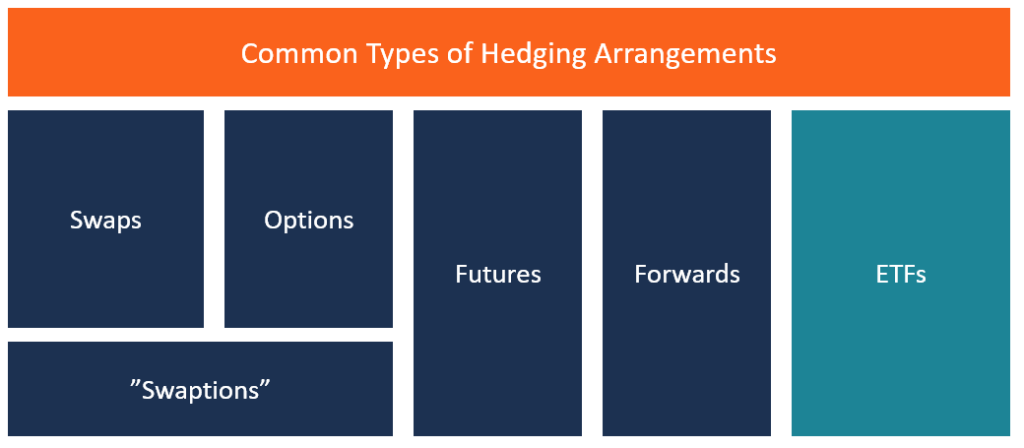

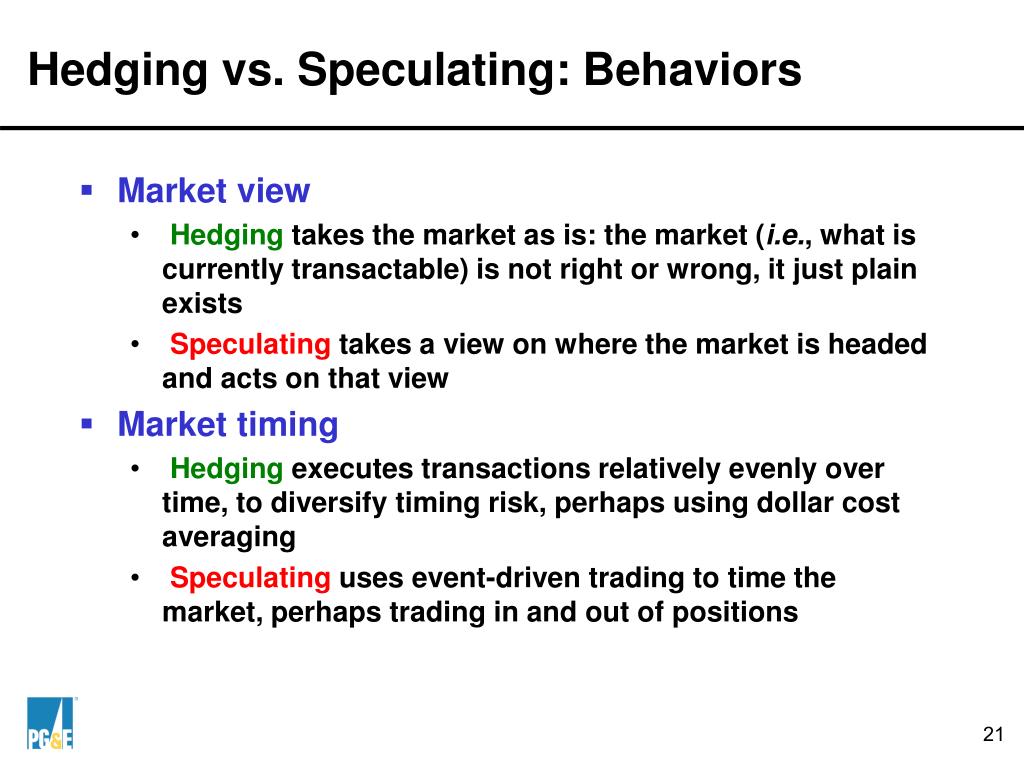

Hedging against investment risk means strategically using instruments in the market to offset the risk of any adverse price movements speculation involves trading a financial instrument involving high risk. You might have heard terms like speculation, hedging, arbitrage, investment, trading etc. Conversely, speculation depends on risk, in the hope of making good returns. Hedging is an action to reduce the various risks associated with the underlying asset. 15:13 kevin bracker 163 270 просмотров. Is that speculation is the process of thinking or meditating on a subject while hedging is the act of one who hedges (in various senses). While investing and speculating are not mutually exclusive, there are some key differences. While reading the business page of your newspaper. Hedging is done to reduce or eliminate risk whereas speculation is done to gain from price change. Hedging is essentially risk management. Short selling is of course a common technique used to mitigate risk and. Are speculators driving commodity prices wild? However, these two terms are very different from each other.

Whats the difference between hedging and speculation? Hedging is an action to reduce the various risks associated with the underlying asset. Futures markets originated as a way for producers to stabilize their income and/or raw material supply amid market fluctuations, but they soon grew into a way for speculators to bet on the direction of a. Hedging against investment risk means strategically using instruments in the market to offset the risk of any adverse price movements speculation involves trading a financial instrument involving high risk. While investing and speculating are not mutually exclusive, there are some key differences.

Speculation ©2013, center for farm financial management, university of minnesota section ii basic pricing tools chapter 13: Speculation, hedging, and arbitragebibliographyarbitrage is the simultaneous purchase and sale of source for information on speculation, hedging, and arbitrage: Is that speculation is the process of thinking or meditating on a subject while hedging is the act of one who hedges (in various senses). Speculating and the role of speculators in the futures markets. Short selling is of course a common technique used to mitigate risk and. Futures markets originated as a way for producers to stabilize their income and/or raw material supply amid market fluctuations, but they soon grew into a way for speculators to bet on the direction of a. Arbitrage and speculation are two distinct financial techniques. Diversification is a portfolio management strategy that investors use to smooth out. I am afraid that the prices of potatoes is going to increase in the future. While investing and speculating are not mutually exclusive, there are some key differences. A question that comes up from time to time is the difference between hedging and speculating, and where to draw a line between the two. Speculation transaction vs investment transactions. In computer architecture, what is difference between (branch) prediction and speculation??

Hedging is an action to reduce the various risks associated with the underlying asset. They make buying and selling decisions based on their expectations of how the market. Hedging against investment risk means strategically using instruments in the market to offset the risk of any adverse price movements speculation involves trading a financial instrument involving high risk. This week, 17 senators wrote to the cftc calling for a plan to impose position limits in all energy futures markets. Now let us understand the difference.

It's important to note that hedging is not the same as portfolio diversification. These seems very similar, but i think there is a subtle distinction between them. Know the difference between arbitrage and speculation by angel broking experts. To view this presentation, you'll need to allow flash. Hello dear traders lets discuss which better for good income without high risk speculation or hedging everyone here can share his experiance with any of them. Hedging is an action to reduce the various risks associated with the underlying asset. Now let us understand the difference. Speculation, hedging, and arbitragebibliographyarbitrage is the simultaneous purchase and sale of source for information on speculation, hedging, and arbitrage: Conversely, speculation depends on risk, in the hope of making good returns. This week, 17 senators wrote to the cftc calling for a plan to impose position limits in all energy futures markets. Hedging against investment risk means strategically using instruments in the market to offset the risk of any adverse price movements speculation involves trading a financial instrument involving high risk. Hedging is done to reduce or eliminate risk whereas speculation is done to gain from price change. While reading the business page of your newspaper.

Speculation Vs Hedging: Short selling is of course a common technique used to mitigate risk and.

Source: Speculation Vs Hedging